ADCB Account Opening Online – Eligibility & Required Documents

ADCB Account Opening has become very easy in present time. Now you do not need to go to the bank and stand in a queue to open an ADCB bank account in the UAE. You can open your ADCB account online.

The online account opening facility is available for all residents or Expats of the United Arab Emirates. However, the non-residents need to visit an ADCB branch to open a bank account.

How to Open ADCB Account Online

You can open an ADCB account online by using the ADCB Hayyak App on your mobile phone. You do not have to be an ADCB customer to use ADCB Hayyak App, actually the Hayyak App is designed to offer ADCB account opening online facility to non-customers living in the UAE.

ADCB Account Opening Documents

- Original Passport

- Original Emirates ID Card

You should keep your Passport and Emirates ID card ready as you will need to scan these documents to open an ADCB account through Hayyak App.

ADCB Online Account Opening Process

The ADCB Hayyak App allows you to open an ADCB bank account online from the comfort of your home or office.

You should download & install ADCB Hayyak App from the Play Store or App Store. The Hayyak App is available for free and here I provide a direct link for you to Download ADCB Hayyak App for Android and Download ADCB Hayyak App for iPhone on your mobile phone.

You can follow the steps given below to open a bank account with ADCB online after downloading ADCB Hayyak App on your mobile.

Step 1: Open ADCB Hayyak App and Select New User

After the ADCB Hayyak App is installed on your phone, just tap on the App icon to open it. Wait for the Hayyak App to load the home screen. Then select “New User” option to continue.

Step 2: Scan Your Passport and Emirates ID

Now, you need to scan your Original Passport and Original Emirates ID Card with ADCB Hayyak App. I recommend you to keep the documents in daylight when scanning to get a proper scan.

After scanning, tap on Submit button to upload your Passport and Emirates ID in Hayyak App.

Step 3: Choose “Save and Transact” Option

After submitting your Passport and Emirates ID, you will see two options as “Borrow” and “Save and Transact”.

- If you want to apply for a Personal Loan, select “Borrow” option.

- If you want to open a Savings Account or Current Account with a Credit Card then select “Save and Transact” option.

Here you should tap on “Save and Transact” option to open an ADCB Account online.

Step 4: Select Your Account Type

Here you have two main options in Account Type i.e. Savings Account and Current Account. You should choose Savings Account to open a bank Account for personal use.

If you want to open a bank account for your business, you should select Current Account. There are subcategories in Savings Account and Current Account, you can check the features & benefits to pick the option that is suitable for you.

Step 5: Fill Up Your Basic Information

A form will appear on your screen, fill it up with your basic information. Provide your registered mobile number, email, address info, monthly income and other personal details as required in the form.

Step 6: Upload Your Signature

You should do your signature with a pen on a white paper and take a picture. Upload your signature as it is required to process and issue your Cheque Book.

Step 7: Choose Your Language and Other Options

You can personalize your ADCB bank account by choosing your desired language for operating your account. It also offers some more options to let you customize your bank account as you like.

Step 8: Your ADCB Account Opens Instantly

As you click on Submit after completing all the steps, your ADCB Account will open instantly. It will take only a few seconds to generate your bank account number and activate your account.

ADCB Zero Balance Account Opening

Many people who work in UAE, want to know about the ADCB Zero Balance Account. So, the bank account opening process is the same as you open a savings/current account through ADCB Hayyak App.

- Open ADCB Hayyak App on your phone.

- Tap on New User to continue.

- Scan your Passport and Emirates ID.

- Choose “Save and Transact”.

- Select Zero Balance Account.

- Fill up the form and upload your Signature.

- Submit the form online to open your account instantly.

When you see the bank account types and options, you need to choose Zero Balance Account. All other steps and required documents are the same. Do check the terms & conditions given by ADCB Bank before you open an ADCB Zero Balance Account through Hayyak App.

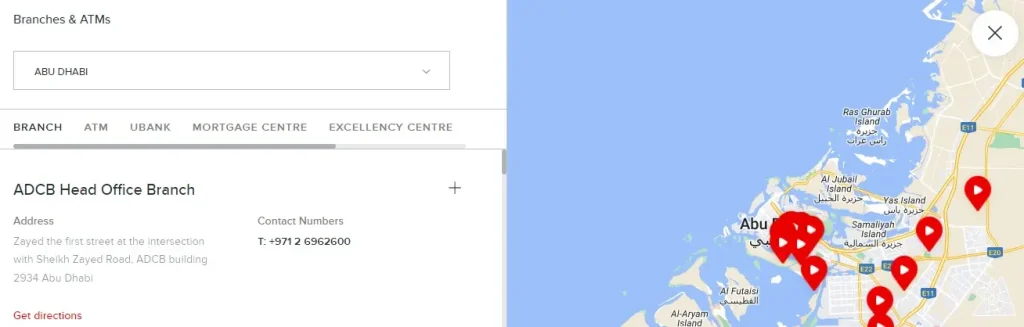

How to Open ADCB Account at Branch

You can go to your nearby ADCB bank branch to open a savings account or current account.

You need to carry all your documents needed for ADCB account opening to complete your account opening application by visit the bank branch only once.

- Click Here to Locate an ADCB bank branch nearby your place.

- Go to your nearest ADCB branch.

- Get the Account Opening Form from a bank executive.

- Fill up the form with your basic and personal details.

- Attach required documents and submit the form.

- Pay the fees & charges, if any, as applicable.

- Exit the bank branch, it may take 24-48 hours to open & activate your bank account.

- You will receive an email and an SMS from ADCB when your account is ready to use.

ADCB Welcome Kit for New Customers

The Abu Dhabi Commercial Bank provides a Welcome Kit for new customers. As your ADCB Account is opened through Hayyak App, the bank will get your Welcome Kit (Welcome Pack) ready in next few hours.

Your ADCB Welcome Kit contains your New ATM cum Debit Card, a Cheque Book and some important instructions from the bank.

There are two options to get your ADCB Welcome Kit after opening your bank account.

- Easy Pick Up – You can pick up your ADCB Welcome Kit from a nearby ADCB bank branch.

- Free Delivery – You can choose “Delivery” option and your Welcome Kit will be delivered to your doorstep in 48 hours of account opening.

ADCB Account Types, Features and Requirements

The ADCB offers a variety of bank accounts with different features and benefits. Each account type has different requirements for a minimum salary, monthly average balance and documents. Check the below table to get complete details about it.

| ADCB Account Type | Features and Benefits | Documents and Requirements |

| ADCB Current Account | Free E-Statement within Statement CycleFree First Cheque Book for AED AccountAlso available in Other Major CurrenciesEarn TouchPoints with Average Monthly Account Balance of AED 25000Access ADCB Personal Internet Banking and Mobile Banking | Minimum Salary of AED 5000For UAE Residents OnlyOriginal PassportOriginal Emirates IDSalary Certificate |

| ADCB Savings & Call Account | Free E-Statement within Statement Cycle0.10% per annum Interest Rate for AED and USD Savings AccountsFor Savings Account, Interest is accrued monthly and paid half-yearly on minimum monthly balanceFor Call Account, Interest is accrued on daily balance and paid monthlyAvailable in AED, USD and Other Major CurrenciesDebit Card available for Savings Account Only | Minimum Salary of AED 5000For Residents and Non-residentsNo Interested paid for Call Accounts with Monthly Account Balance Less than AED 15 or 5 USDNo Debit Card for Call AccountFor UAE ResidentsOriginal PassportOriginal Emirates IDSalary CertificateFor Non-residentsOriginal PassportUAE Visit Visa Copy with Entry Stamp or e-Gate CardLast 3 Month Stamped Bank Statement of Existing Bank AccountA letter of introduction from an existing ADCB customer with a relationship of more than a year |

| [a] Emirati Millionaire Savings Account[b] Emirati Youth Millionaire Savings Account for customers under the age of 21 | List of Prizes:AED 1 Million Prize for 1 Winner Every MonthAED 2 Million Prize for 2 Winners in a YearLuxury Car Prize for 1 Winner Every 3 MonthsAED 300,000 Cash Prize Per Quarter for Customers Under the Age of 21AED 10,000 Prize for 10 Winners Every MonthAccount Features:Debit Card FacilityAccount Available for Children but One of their Parents or Legal Guardians Need to Manage ItProfit on Savings Announced & Paid QuarterlyFor every AED 1000 savings added to initial deposit of AED 5000, offer an extra chance to win in the prize draws | Only for Emiratis (UAE Nationals/Citizens)Minimum Average Monthly Balance of AED 5000Customers under the Age of 21 are eligible for quarterly prize and other prizes except top 3 prizesDebit Card is Not available for Customers under the Age of 15 |

| [a] Millionaire Destiny Savings Account[b] Youth Millionaire Destiny Savings Account for customers under the age of 21 | List of Prizes:AED 1 Million Prize for 1 Winner Every MonthAED 2 Million Prize for 2 Winners in a YearLuxury Car Prize for 1 Winner Every 3 MonthsAED 300,000 Cash Prize Per Quarter for Customers Under the Age of 21AED 10,000 Prize for 10 Winners Every MonthAccount Features:Debit Card FacilityAccount Available for Children but One of their Parents or Legal Guardians Need to Manage ItProfit on Savings Announced & Paid QuarterlyFor every AED 1000 savings added to initial deposit of AED 5000, offer an extra chance to win in the prize draws | Minimum Average Monthly Balance of AED 5000Customers under the Age of 21 are eligible for quarterly prize and other prizes except top 3 prizesAED 25 Maintenance Fee is charged if Monthly Average Balance falls below AED 3000If a Customer holds another product with this Account, normal Relationship Based Pricing (RBP) will be appliedDebit Card is Not available for Customers under the Age of 15 |

| ADCB Active Saver Account | Up to 2.25% per annum Interest Earning on AED AccountUp to 2% per annum Interest Earning on USD AccountInterest is calculated on daily basis on closing balance and paid on monthly basisAccount can be opened instantly through ADCB Personal Internet BankingAvailable in AED, USD and GBP Currencies | Monthly Fee is charged if respective segment-wise relationship balance criteria is not metAdditional Statement outside normal cycle is chargeableEligibility Criteria:For UAE nationals and residents with valid visa onlyMinimum Age is 21 YearsTo open an Active Saver Account, you should first have an ADCB Current or Savings AccountAn Active Saver Account cannot be opened as a joint account or for a minor |

| Etihad Guest Aspire Account | Free E-Statement within Statement CycleFree First Cheque Book for Current AccountATM cum Debit Card for Savings and Current AccountsEarn 2 Etihad Guest Miles for every AED 1,000 maintained monthly in your current or savings account (with minimum monthly average balance: AED 10,000 and maximum average monthly balance: AED 250,000)Earn a bonus of 500 Etihad Guest Miles on the first anniversary with ADCB BankEarn a bonus of 500 Etihad Guest Miles on the first-time registration with ADCB Personal Internet Banking | For Residents working in UAENot available for Non-residentsMinimum Salary of AED 5000Monthly Fee is charged if Aspire relationship balance criteria is not metRequired Documents:Original Emirates IDOriginal Passport with UAE Residence Visa valid for more than 30 daysSalary Certificate |

| [a] Etihad Guest Privilege Account[b] Etihad Guest Excellency Account | Free E-Statement within Statement CycleFree First Cheque Book for Current AccountATM cum Debit Card for Savings and Current AccountsEarn 3 Etihad Guest Miles (Privilege Account) and 4 Etihad Guest Miles (Excellency Account) for every AED 1,000 maintained monthly in your current or savings account (with minimum monthly average balance: AED 10,000 and maximum average monthly balance: AED 250,000)Earn a bonus of 500 Etihad Guest Miles on the first anniversary with ADCB BankEarn a bonus of 500 Etihad Guest Miles on the first-time registration with ADCB Personal Internet Banking | Minimum Salary of AED 20,000Monthly Fee is charged if Aspire relationship balance criteria is not metEligibility Criteria:Current Account – For Residents working in the UAESavings Account – For Residents and Non-resident CustomersRequired Documents:For UAE ResidentsOriginal Emirates IDOriginal Passport with UAE Residence Visa valid for more than 30 daysSalary CertificateFor Non-residentsOriginal PassportUAE Visit Visa Copy with Entry Stamp or e-Gate CardLast 3 Month Stamped Bank Statement of Existing Bank AccountA letter of introduction from an existing ADCB customer with a relationship of more than a year |

From a variety of ADCB Account Types shared above, you can choose a bank account according to your eligibility and personal choice. Thereafter you can open an ADCB Bank Account Online through ADCB Hayyak App or visit an ADCB bank branch to open an account.

ADCB Customer Care

The ADCB Account Opening Service is very easy. In case you face any issue or you have queries regarding any account type, feel free to contact ADCB Customer Care Number and Email.

- ADCB Customer Care within UAE: 600 50 2030

- ADCB Customer Care Islamic Banking: 600 56 2626

- ADCB Customer Care Outside UAE: +971 2 6210090

- ADCB Customer Care Email: [email protected]

Summary

The Abu Dhabi Commercial Bank provides online account opening service for all UAE residents. Based on your account choice and eligibility, you can apply to open your ADCB Account through ADCB Hayyak App from your home or anywhere in the UAE.

I have shared different types of ADCB Accounts with their features, benefits, eligibility criteria and required documents. If you still have any query, call up ADCB Customer Care or ask your questions in the comment section below.

FAQs

How can I open a bank account with ADCB?

You can open a bank account with ADCB online via ADCB Hayyak App or by visit an ADCB bank branch.

Can I open a zero balance account online in ADCB?

Yes, you can open a zero balance account online in ADCB using the ADCB Hayyak App.

What is ADCB Account Opening Fee?

The ADCB Bank does not charge any ADCB Account Opening Fee online or in-person.

Can expats in UAE open an ADCB account online?

Yes, the expats in UAE can open an ADCB account online through ADCB Hayyak App if they meet required eligibility criteria and have necessary documents.

Can I get a Free Cheque Book with my ADCB account?

Yes, you can get a Free Cheque Book with your ADCB Current Account. The ADCB offers the first cheque book for free for current accounts, savings account holders can apply for a cheque book with a nominal fee.