How to Open FAB iSave Account – Eligibility, Features and Advantages

FAB iSave Account is a zero balance savings account with high interest rates. The existing customers of First Abu Dhabi Bank can open an iSave Account online to earn more interest than their regular savings account.

In order to open an FAB iSave Account, you do not need to visit any FAB bank branch. You can easily apply for opening FAB iSave Account online. Once the account is opened and activated, you can deposit money to your iSave Account and enjoy earning up to 5.25% interest per annum.

The interest is subject to eligibility determined by FAB on the basis of average monthly balance.

Reasons to Open FAB iSave Account

In present time, it is important to learn how to grow your earned money with the least risk. The First Abu Dhabi Bank offers so many features and advantages with FAB iSave Account. Here I provide the key advantages of FAB iSave Account as follows;

No need to visit the bank branch to open an FAB iSave Account.

The FAB iSave Account offers you 5.25% interest rate on the amount you deposit in your iSave account.

The FAB bank does not put any restriction on cash withdrawals. There is no locking period, so you can withdraw all the money whenever you want.

No need to maintain any minimum balance in the account.

No account maintenance fee and No hidden charges.

These are the reasons why you should open an FAB iSave Account in 2024.

Eligibility Criteria for FAB iSave Account

The First Abu Dhabi Bank has set specific eligibility criteria for FAB iSave Account. So, it is important to check your eligibility before you apply to open an iSave Account online.

- FAB iSave Account is for existing customers only.

- FAB iSave Account is for individual customers only.

- The customer must be a UAE resident with a valid Emirates ID.

- The customer must be a minimum of 18 years old to open an iSave Account.

Required Documents

In order to open an FAB iSave Account with First Abu Dhabi Bank, you must provide some important documents. Here is the list of documents required for opening an iSave Account online in UAE.

- Emirates ID Card

- The bank may request Address Proof and Income Proof documents if needed.

How to Open FAB iSave Account

You can open FAB iSave Account online by visiting the FAB website. You can also use the mobile banking application of the First Abu Dhabi Bank.

It is important to learn the FAB iSave Account Opening Process before you apply online for it. In this article, I will guide you with a step-by-step process for opening an FAB iSave Account online using two different methods as under;

- Open FAB iSave Account Online at FAB Bank Website

- Open FAB iSave Account through FAB Mobile App

Let us explore each method to apply to open an iSave Account with FAB bank.

#1. Open FAB iSave Account Online at FAB Bank Website

The First Abu Dhabi Bank provides many banking features and facilities on its website portal. The FAB customers can visit the official website of the bank to access these services and open an iSave Account online instantly.

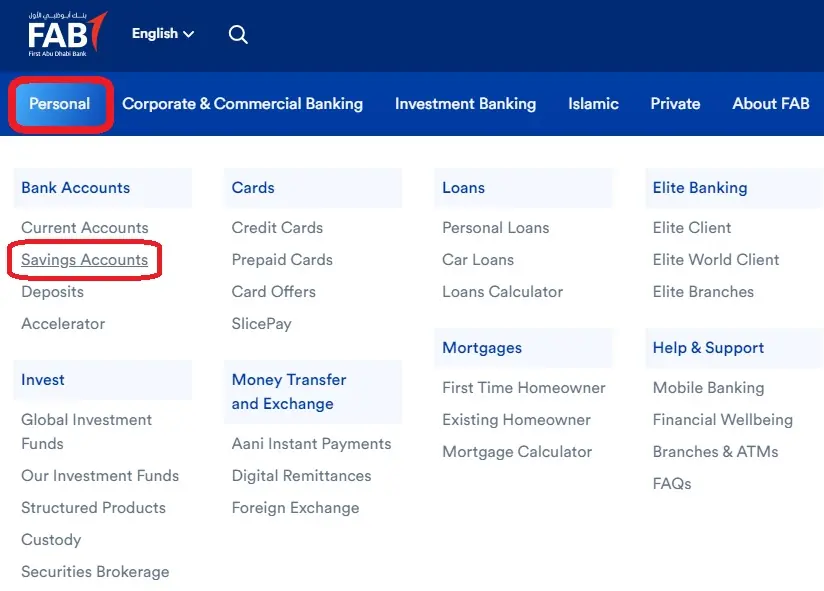

01. Go to FAB Bank official website @www.bankfab.com.

02. Select Personal tab and click on Savings Accounts option.

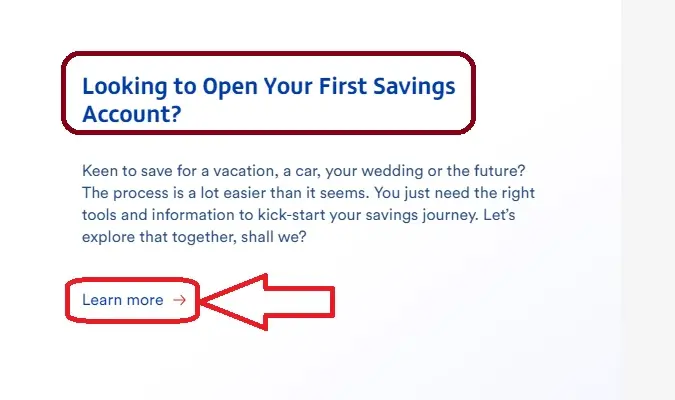

03. Click on Learn More under Looking to Open Your First Savings Account?

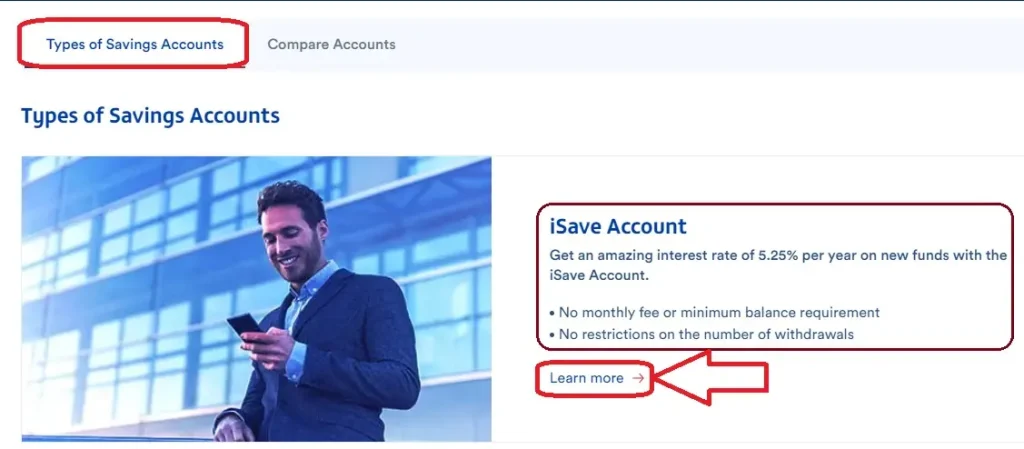

04. Scroll down to Types of Savings Accounts and click on Learn More for iSave Account.

05. Read iSave Account Features & conditions and scroll down to Apply Now section.

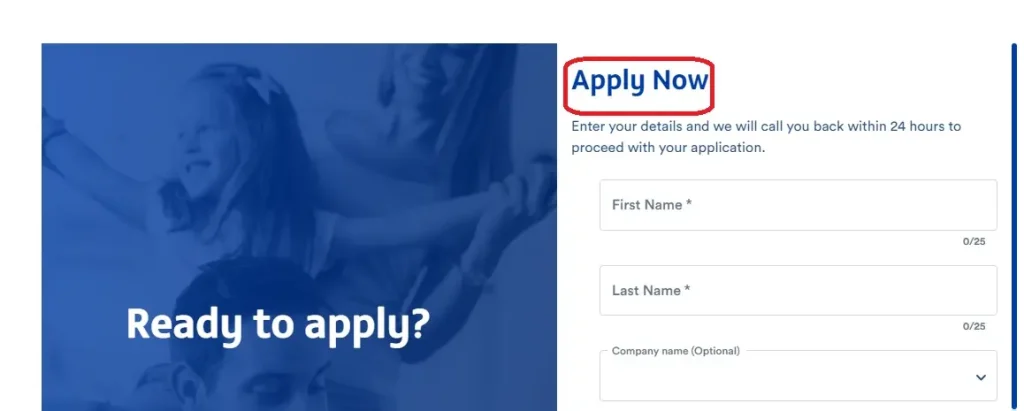

06. Enter your First Name & Last Name same as printed on your Emirates ID Card.

07. Provide Your Company Name, Email and Mobile Number.

08. Select your Emirate, enter your Monthly Salary amount and provide your Nationality.

09. Tick the box I read and accept the Terms and Conditions.

10. Finally, click on Apply Now button to proceed.

After you complete the above steps, you need to wait for 24 hours. An FAB bank executive will call you to assist in the iSave Account opening process, you will need to follow the instructions given by the FAB executive to open your FAB iSave Account and start earning interest.

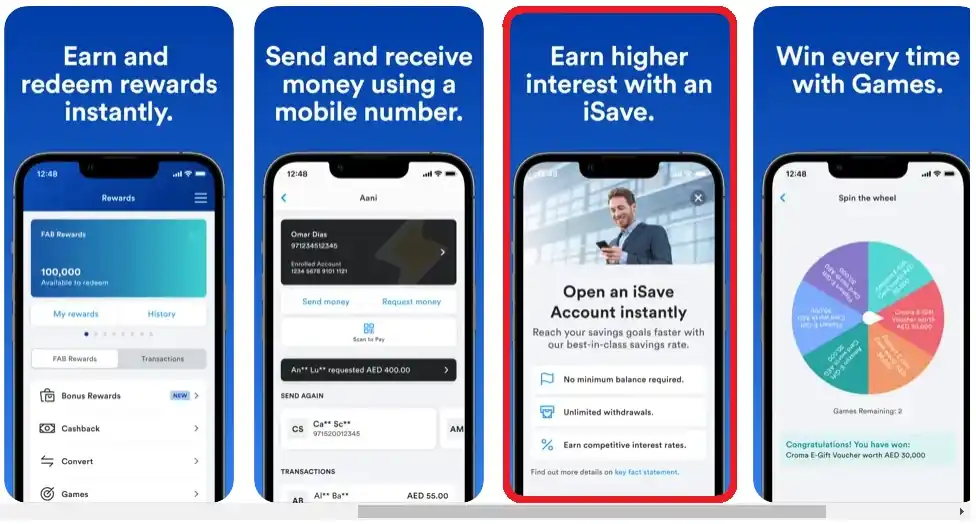

#2. Open FAB iSave Account through FAB Mobile App

The FAB Mobile Banking Application is available for free for all customers. The FAB customers with an Android Smart Phone or iPhone/iPad or Huawei Mobile can apply to open FAB iSave Account through FAB Mobile App from their mobile phone.

The customers can use the links shared here to download FAB Mobile Banking App on their mobile phone.

Get FAB Mobile App for Android or iPhone/iPad or Huawei Phone

After you download the FAB Mobile App on your phone, just go through the following steps to open your iSave Account FAB via mobile app.

- Open FAB Mobile App on your phone.

- Sign Up and Login to the app with necessary details.

- Find and select iSave Account in Savings Accounts section.

- Fill up FAB iSave Account Form with your name, Emirates ID, mobile number, email, salary, nationality and other details.

- Submit the form to finish the process.

- Soon you will receive an email from FAB that your iSave Account is opened and ready to use. Thereafter you can deposit money to your iSave Account FAB online.

Generally, the FAB iSave Account is opened instantly or in a few minutes. Sometimes, it takes up to 24 hours to review and process the application and open the iSave Account.

Competitive Interest Rates on FAB iSave Account

The FAB iSave Account is known for its impressive interest rates. The FAB bank offers 4% to 5.25% interest per year on the monthly average balance maintained by the customer during a specific campaign period.

- The individual customers can earn 4% interest per year by adding new funds to their FAB iSave Account from 1 July 2022 to 30 April 2023.

- The individual customers can earn 5.25% interest per year on new funds deposited to their FAB iSave Account from 1 May 2023 to 30 September 2024.

- The base balance for 5.25% per year interest rate is the overall balance in the customer’s iSave Account as on 30 April 2023.

- The campaign period was to end on 30 April 2023 but the FAB bank extended it for four more months i.e. June, July, August and September. Now, this extended period has affected the interest calculation.

- The FAB will apply a differential interest rate over the prevailing interest rate within 45 days from the campaign extension end date i.e. 30 September 2024 for the four extension months i.e. June, July, August and September.

- For the existing funds in the FAB iSave Account until 30 June 2022, the FAB will calculate interest as per the interest rate range mentioned below.

| Band Balance | Interest Rate Range (per year) |

| < AED 500,000 | Up to 2.465% |

| AED 500,000 to < AED 5,000,000 | 2.465% to 3.251% |

| ≥ AED 5,000,000 | 3.251% and less |

Bottom Line

The FAB iSave Account is the best option for individual customers to achieve their savings goals. The First Abu Dhabi Bank offers competitive interest rates to encourage customers to deposit funds into their iSave Account and maintain it to earn interest on a regular basis.

In this article, I have explained FAB iSave Account opening process, eligibility, required documents and its key advantages. For any query, you can ask it in the comment section.

FAQs

Can I open my FAB iSave Account on mobile?

Yes, you can open your FAB iSave Account on mobile with help of FAB Mobile Banking Application.

How much interest can I earn from FAB iSave Account?

You can earn up to 5.25% interest per year from the FAB iSave Account.

When can I withdraw funds from my FAB iSave Account?

You can withdraw funds from your FAB iSave Account at anytime. The FAB does not put any restriction on withdrawals for iSave Account.

What is the minimum balance for FAB iSave Account?

The minimum balance for FAB iSave Account is Zero. The customer does not need to maintain any balance in their iSave Account.

Can I open FAB iSave Account with my Passport?

No, you must have a valid Emirates ID top open an FAB iSave Account.